Sign up for a free trial:

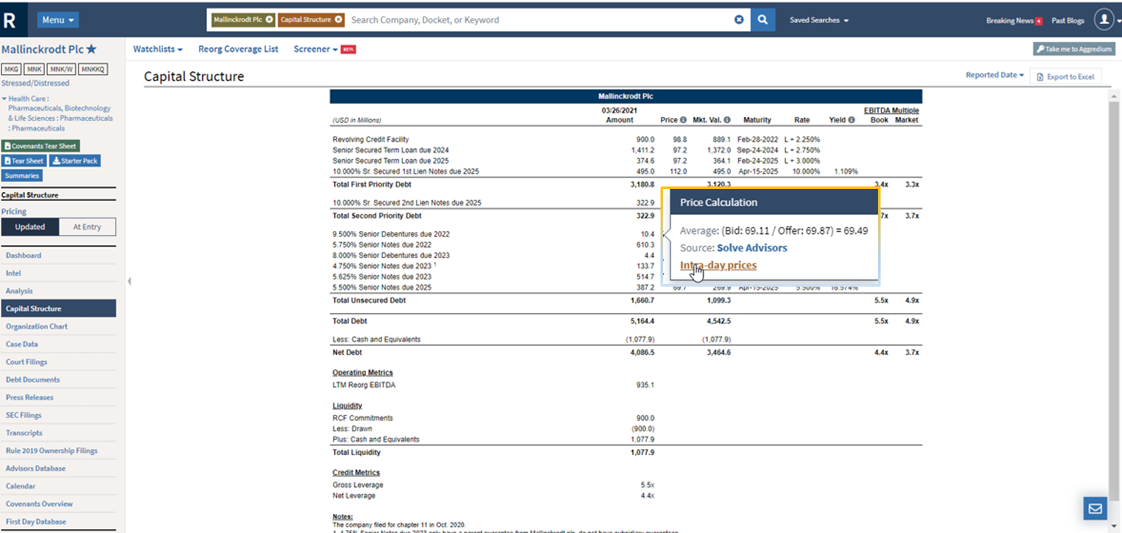

- Capital Structure: Real-time market color and intra-day pricing across the Capital Structure

- Screener Tool: Solve pricing data within Reorg's screening tool to identify largest price movers

SOLVE features accessible via Octus Credit Cloud:

- Coverage on Corporate Bonds, Syndicated Bank Loans, CDS, and Municipal Bonds

- SOLVE's Composite pricing is derived utilizing the most recent observable market data and a unique weighting system within an algorithm to account for factors such as provider strength vs. message and quote strength, etc.

- Market value calculation

About SOLVE

Powered by the industry’s most advanced and flexible technology, SOLVE enables you to collect more data and insights at the times and in the manner you need.

The SOLVE platform uses natural language processing and machine learning to extract all bids, offers, and other pricing discussions from clients' emails. It overlays this information with trade commentary from contributors, helping to provide price transparency and tools that enhance your daily efficiency.

Access

Coverage on 4MM+ securities across five asset classes (Structured Products, Corporates, CDS, Bank Loans, Municipals).

Accuracy

Our technology doesn’t depend on templates; it can pick up pricing from regular interactions, so data isn’t dropped or duped.

Insight

Real-time and historical pricing, streamlined BWICs and Dealer Inventories, relative value and liquidity analysis so you know the true depth of the market.

Flexible Integration and Security

Partner integrations with INTEX, Moody’s, and others, plus Excel add-ins, API access, and data feeds provide the flexibility you need but rarely find.