See SOLVE Relative Value Analysis in Action – Request a Trial

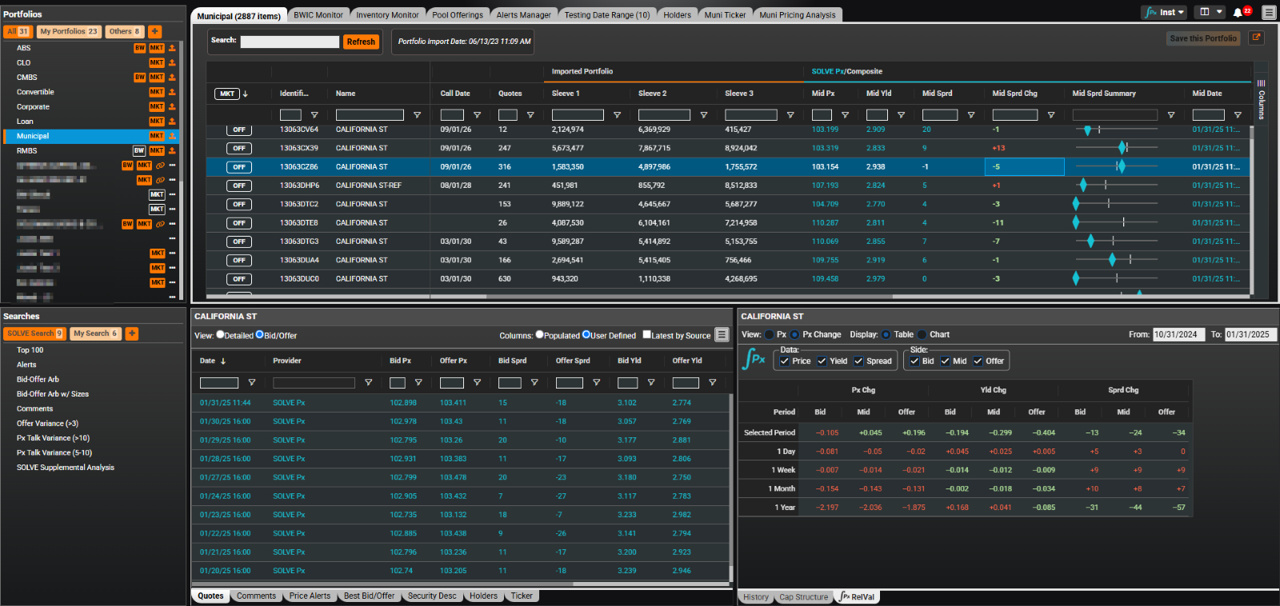

With SOLVE Relative Value Analysis, fixed income specialists benefit from superior analytics to drive trading workflows, understand price richness, and compare various metrics like price, spread and yield values.

Access powerful insights and make more informed trading decisions with SOLVE’s Relative Value Analysis. Request a demo today and explore how you can:

Trade Smarter with Real-Time Insights

- Instantly assess whether a bond is rich or cheap by comparing historical pricing, yields, and spreads.

- Sort and filter data to quickly spot trends and anomalies, helping you react faster to market shifts.

Identify High-Value Trading Opportunities

- Find mispriced securities by comparing asset values across similar bonds.

- Use SOLVE Quotes’ advanced search and filtering to eliminate overpriced or undervalued options.

- Analyze portfolio positions to highlight rich or cheap holdings and track key price movements.

Customize, Search & Act Faster

- Gain a structured, side-by-side view of price, spread, and yield data with SOLVE Px Relval.

- Effortlessly filter, sort, and configure searches to detect market trends instantly.

- Take action with confidence using data-backed insights tailored to your strategy.

Experience SOLVE Firsthand – Request Your Trial Today.

Interested in learning more? Sign up to speak to a SOLVE Relative Value Analysis expert.

Sign-up now for an exclusive look at SOLVE Relative Value Analysis and see how our AI-driven predictive pricing can redefine your market strategy.

Disclaimer:

SOLVE offerings are not intended to constitute investment advice, do not seek to value any security, and do not purport to meet the objectives or needs of specific individuals or accounts.